nanny tax calculator florida

Same rules apply for a nanny share. Learn all the 2022 household employment rules you need to follow.

![]()

Paycheck Nanny On The App Store

Nanny Tax Calculator Use GrossNet to estimate your federal and state tax obligations for a household employee.

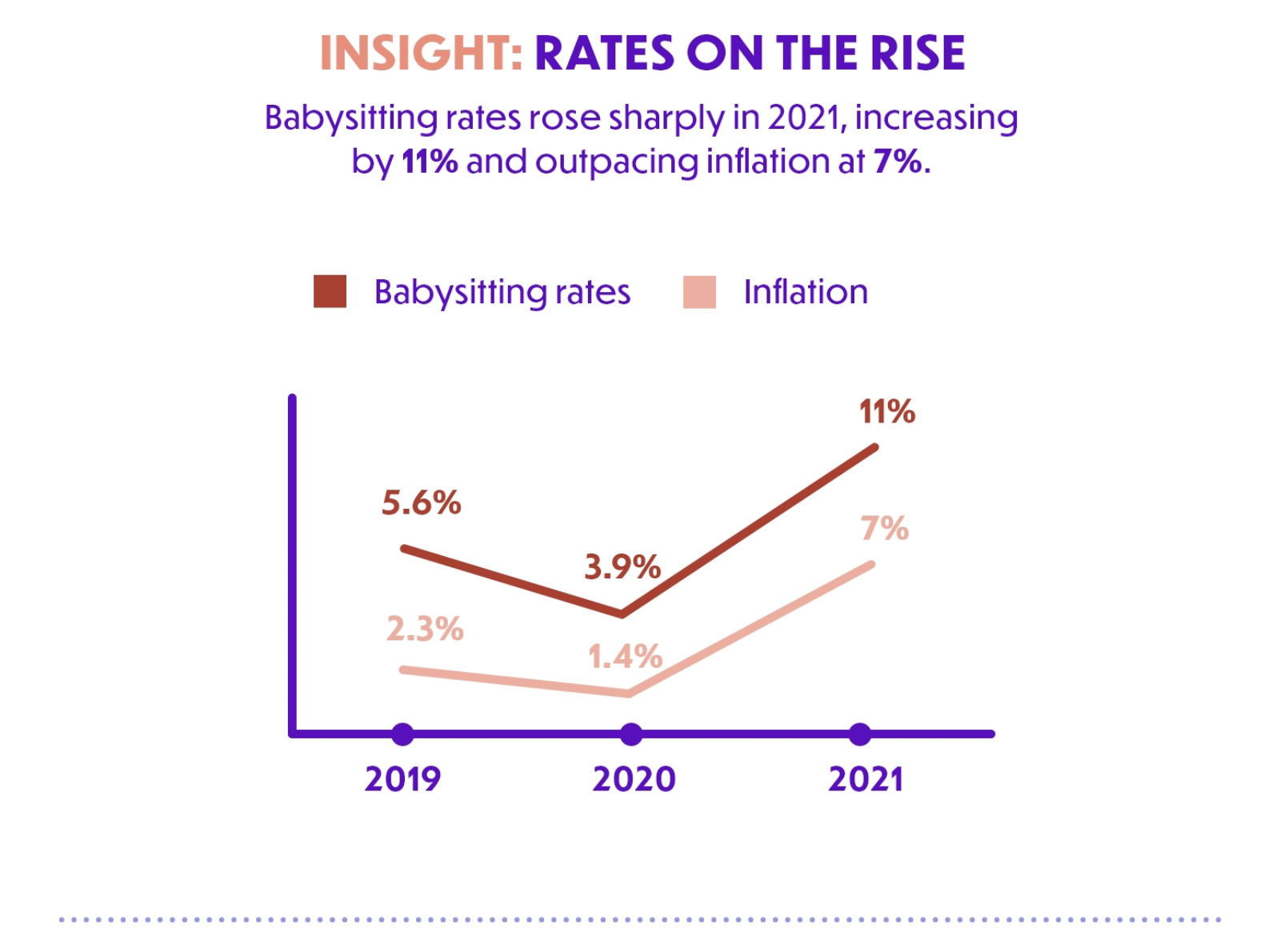

. Nanny tax and payroll calculator BUDGET ONLY PAYCHECK AND BUDGET Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. One of the best things about being a nanny for a nanny share is that nannies typically make more money. This may vary if you have previous employees.

Simply multiply your nannys gross wages by 765 to get your FICA tax responsibility. Nanny tax calculator for a nanny share. Nanny Tax Calculator Leading Nanny and Maternity Nurse Agency UK London - myTamarin The Nanny Tax Calculator This calculator will help you understand the total cost of employing a.

That means that your net pay will be 45925 per year or 3827 per month. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. Nanny tax calculator florida Sunday March 20 2022 Edit.

Florida requires a new employer state unemployment insurance tax of 27 for the first 7000 wages paid to each employee. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare.

Here are five helpful ways to use a nanny tax calculator. Overview of Florida Taxes. Nanny Tax Calculator GTM Payroll Services Inc.

Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. If youre moving to Florida from a state that levies an income.

Estimate Your Tax Obligation. If you make 55000 a year living in the region of Florida USA you will be taxed 9076. These taxes are collectively known as FICA and must be withheld from your nannys pay.

When budgeting for a nanny it helps to figure out your employer tax responsibility. Use Salary vs Overtime to calculate employee overtime pay. For example if your nanny grosses 800week then your FICA tax for that pay.

What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll How To Pay Your Nanny S Taxes Yourself. Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no. Login Nanny Tax Calculator Use GrossNet to estimate your federal and state tax obligations for a household employee.

5 Best Nanny Payroll Services 2022

Salaries And Payroll Tiny Treasures Nyc Nanny Agency

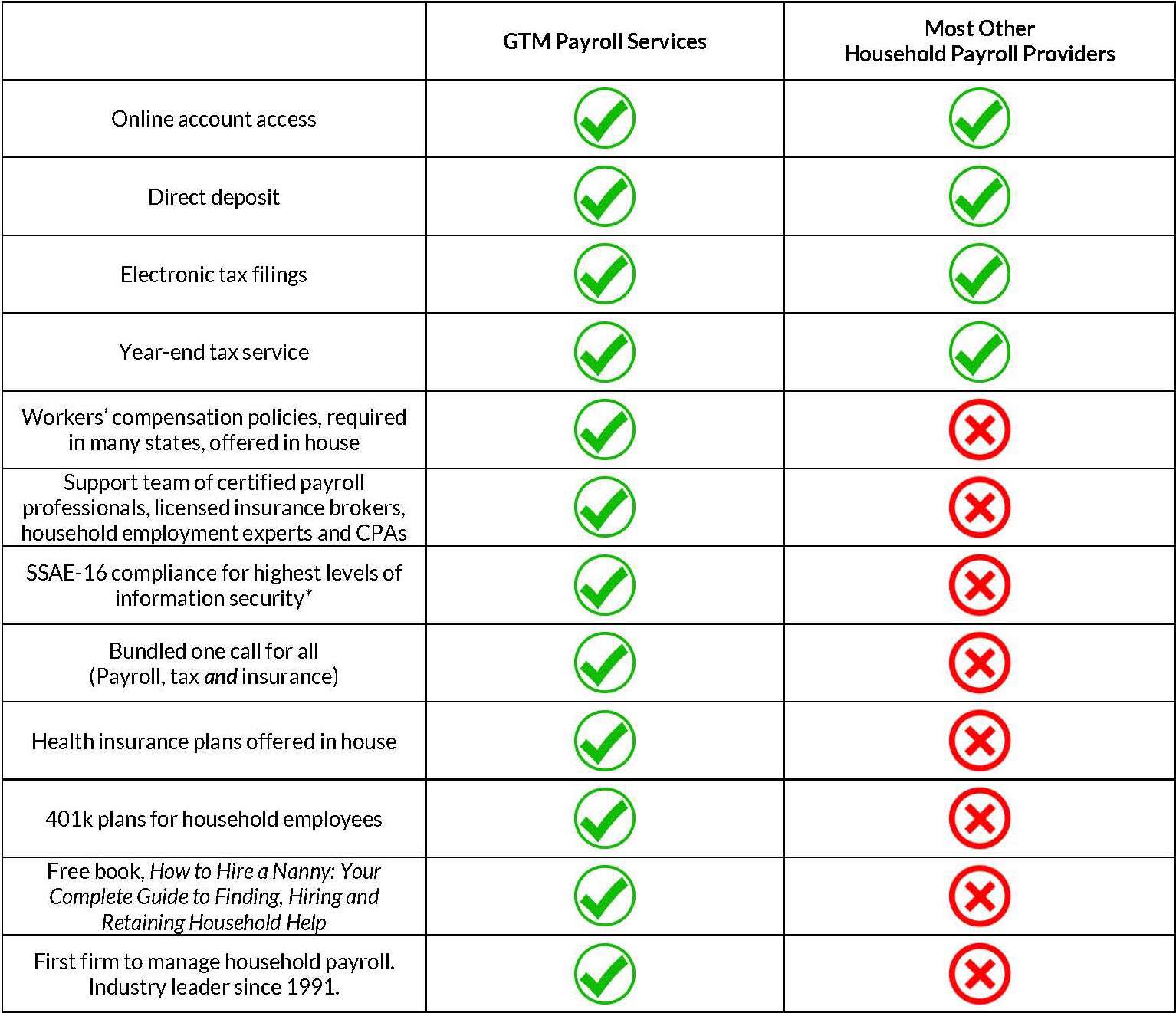

Nanny Payroll Service Comparison Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Parenting Babysitter Nanny And Infant Care Blog Nannypod

5 Answers You Need When Using A Nanny Tax Calculator

Florida Paycheck Calculator Tax Year 2022

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Taxes Made Easy With Poppins Payroll The Mommy Spot Tampa Bay

Ohio Paycheck Calculator Smartasset

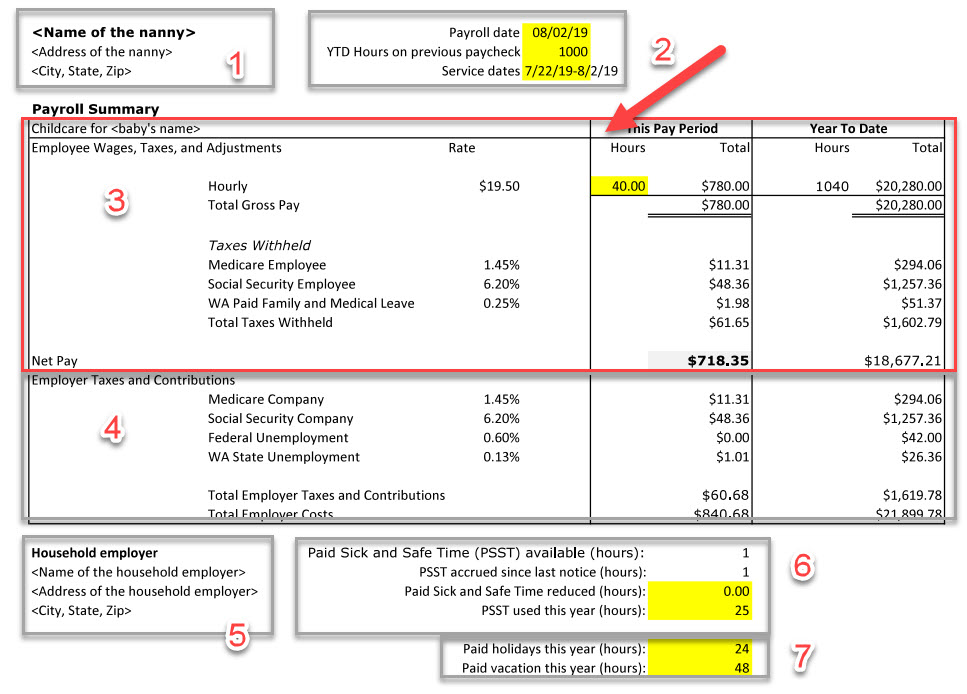

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Targeted Industry Tax Incentives In Florida The Devoe L Moore Center Blog

Paycheck Nanny On The App Store

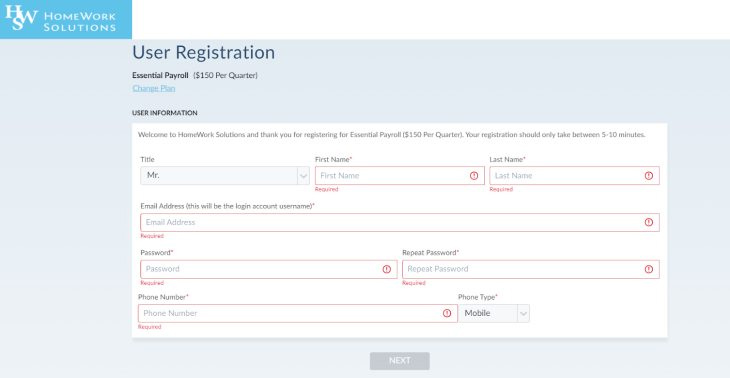

Paying A Nanny Partly On Off The Books Homework Solutions

Nannychex Hourly Paycheck Calculator

5 Best Nanny Payroll Services 2022

Individual Tax Carr Riggs Ingram Cpas And Advisors

Nanny Taxes Made Easy With Poppins Payroll The Mommy Spot Tampa Bay